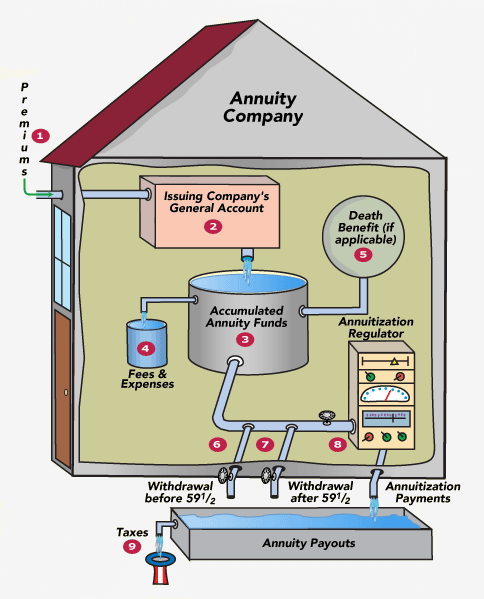

How a Fixed Deferred Annuity Works

- In the accumulation phase, you (the annuity owner) send your premium payment(s) (all at once or over time) to the annuity issuer. If these payments are made with after-tax funds, you may invest an unlimited amount.

- The annuity issuer places your funds in its general account.* Your annuity contract specifies how your principal will be returned as well as what rate(s) of interest you’ll earn during the accumulation phase. Your contract will also state what minimum interest rate applies. **

- The compounding interest on your annuity accumulates tax-deferred. You won’t be taxed on these earnings until funds are withdrawn or distributed.

- The issuer may collect fees to manage your annuity account. You may also have to pay the issuer a surrender fee if you withdraw money in the early years of your annuity.

- Your annuity contract may contain a guaranteed** death benefit or other provisions for a payout upon the death of the annuitant. (As the annuity owner, you’re most often also the annuitant, although you don’t have to be.)

- If you make a withdrawal from your deferred fixed annuity before you reach age 59½, you’ll not only have to pay tax (at your ordinary income tax rate) on the earnings portion of the withdrawal, but you may also have to pay a 10 percent premature distribution tax, unless an exception applies.

- After age 59½, you may make withdrawals from your annuity without incurring any premature distribution tax. Since nonqualified annuities have no minimum distribution requirements, you don’t have to make any withdrawals. However, your annuity contract may specify an age at which you must begin taking income payments.

- To obtain a guaranteed ** fixed income stream for life or for a certain number of years, you could annuitize, which means exchanging the annuity’s cash value for a series of periodic income payments. The amount of these payments will depend on a number of factors, including the cash value of your account at the time of annuitization, the age(s) and gender(s) of the annuitant(s), and the payout option chosen. Usually, you can’t change the payments once you’ve begun receiving them.

- You’ll have to pay taxes (at your ordinary income tax rates) on the earnings portion of any withdrawals or annuitization payments you receive.

* These funds are invested as part of the general assets of the issuer and are therefore subject to the claims of its creditors.

** All guarantees are subject to the claims-paying ability of the issuing company.

Content originated by Broadridge Resource Center